Digital Onboarding Solution

Acquire and Verify Customer Identity In-branch and Online – Cost Effectively

Simplify your in-branch and remote customer onboarding and authentication process by leveraging on Biometrics and a mix of intelligent capture, real-time scanning and AI.

COMPAS Digital Onboarding offers a powerful identity verification service to perform evidence validation, user verification, and counter-fraud checks. The result is an identity assertion and a level of assurance that genuinely gives the financial institution the confidence needed to proceed in safety. Users’ privacy is guaranteed.

Top Challenges Addressed by COMPAS Customer Onboarding Solution

- Eliminates manual, paper based application process

- Quickens the onboarding time

- Reduces the cost of acquiring new customers drastically

- Reduces customer abandonment

Easy in-Branch and Remote Onboarding and Authentication

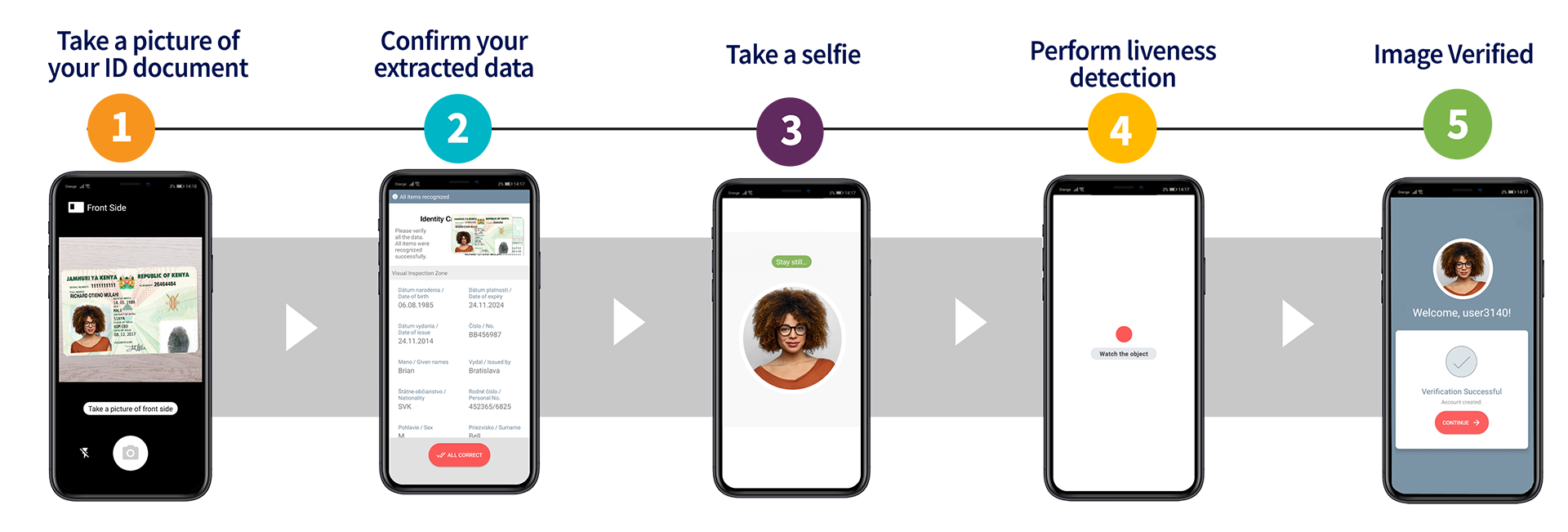

COMPAS makes Digital Onboarding easy for customers through 4 simple steps

- Validate the customer’s government issued ID and documents

- Take a picture and finger print of the customer

- A) Determine facial liveness detection using face algorithm -is the live picture a real person or a spoofed presentation using an image, cut out, video or mask?

- B) System will authenticate the fingerprint from existing DB to validate if such fingerprint has been captured before or not

- If verification is successful, validate that the person pictured in the ID is a match with the person presenting the documents

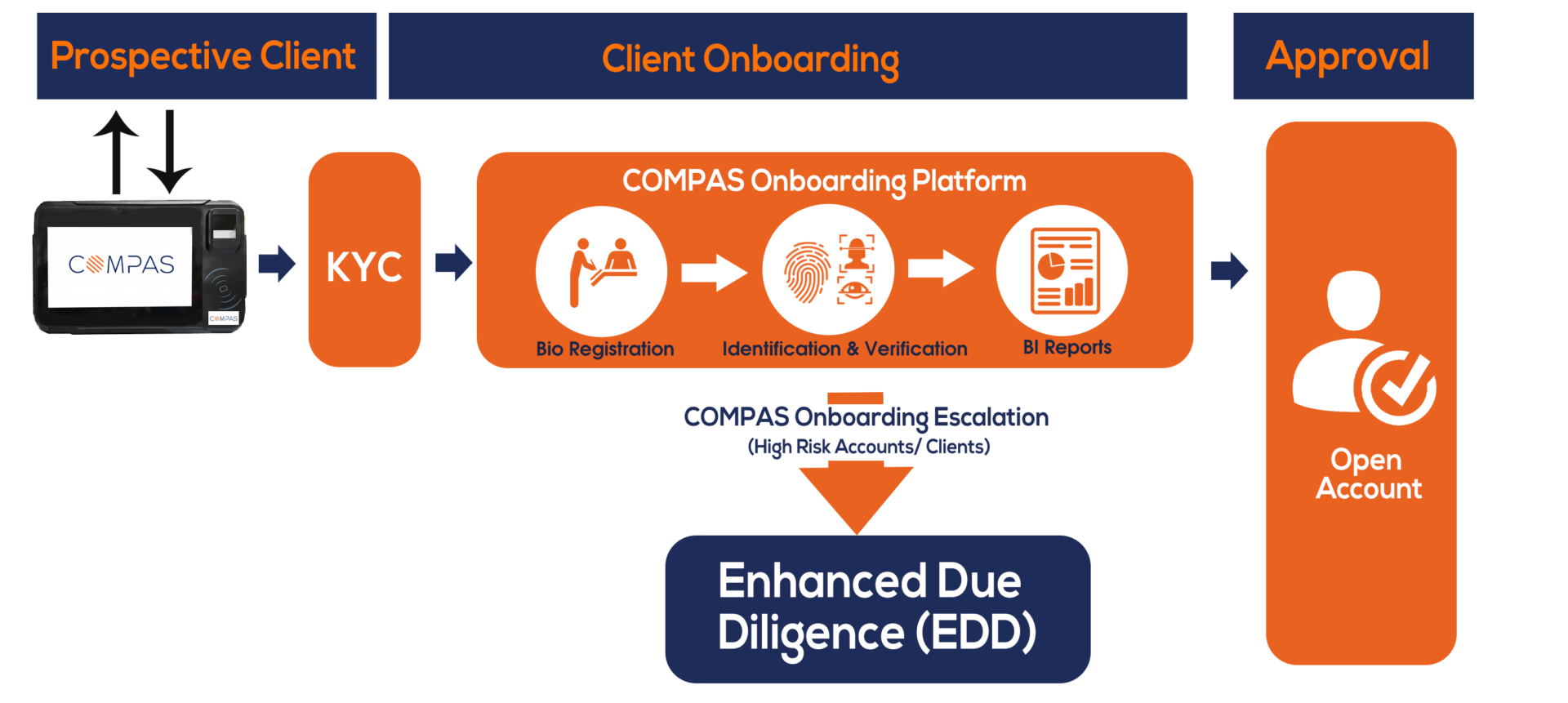

COMPAS In Branch Onboarding Process Flow

COMPAS Remote Onboarding Process Flow

Trusted by Top Players in The Banking Financial Services

Key Features That Make Your Customer Onboarding Work Easier

- Automated OCR – ID data extraction with high accuracy even with low-quality ID pictures. Error-tolerant.

- Easy Integration – Ready to use toolkit. Pick only the functions you need.

- Unique Liveness Detection – User-friendly anti-spoofing technology. Works on any mobile phone.

- Web editor for ID templates – Quick and easy addition of any ID document type using only a small number of ID samples.

- Facial Authentication – Selfie login and data protection based on continuous identity verification.

- Security – Server based biometric identification.

Ready to Experience the Difference with COMPAS KYC solution?

Stop worrying about technology problems. Focus on your business.

Let us provide the support you deserve.