Free Up your Business from the Complexities of eKYC Management

In a Digital-first world, businesses subject to Electronic KYC Solution requirements must find a way to create an onboarding and authentication process that achieves compliance and prevent fraud without alienating your customers. COMPAS Biometric eKYC solution enables you to achieve this and more.

The solution authenticates transactions at Automatic Teller Machines (ATMs), Core Banking System, Internet Banking, Mobile Banking, and Auto Branches, offering customers more secure cash withdrawals and deposits without using cards or PIN codes. It also offers additional security features for a traditional card and PIN-based EMV transactions using two-factor authentication. Encrypted biometric templates are stored safely inside the bank’s secure environment in a central server or on a suitable smart card.

Top 3 Reasons to Trust Biometric eKYC When Identity Matters

- Quickly Identify and verify customers with a biometric scan

- Prevent account takeover and online fraud

- Comply with regulations and directives including AML and KYC

Strike a balance between User experience and KYC Compliance – Enrollment Process

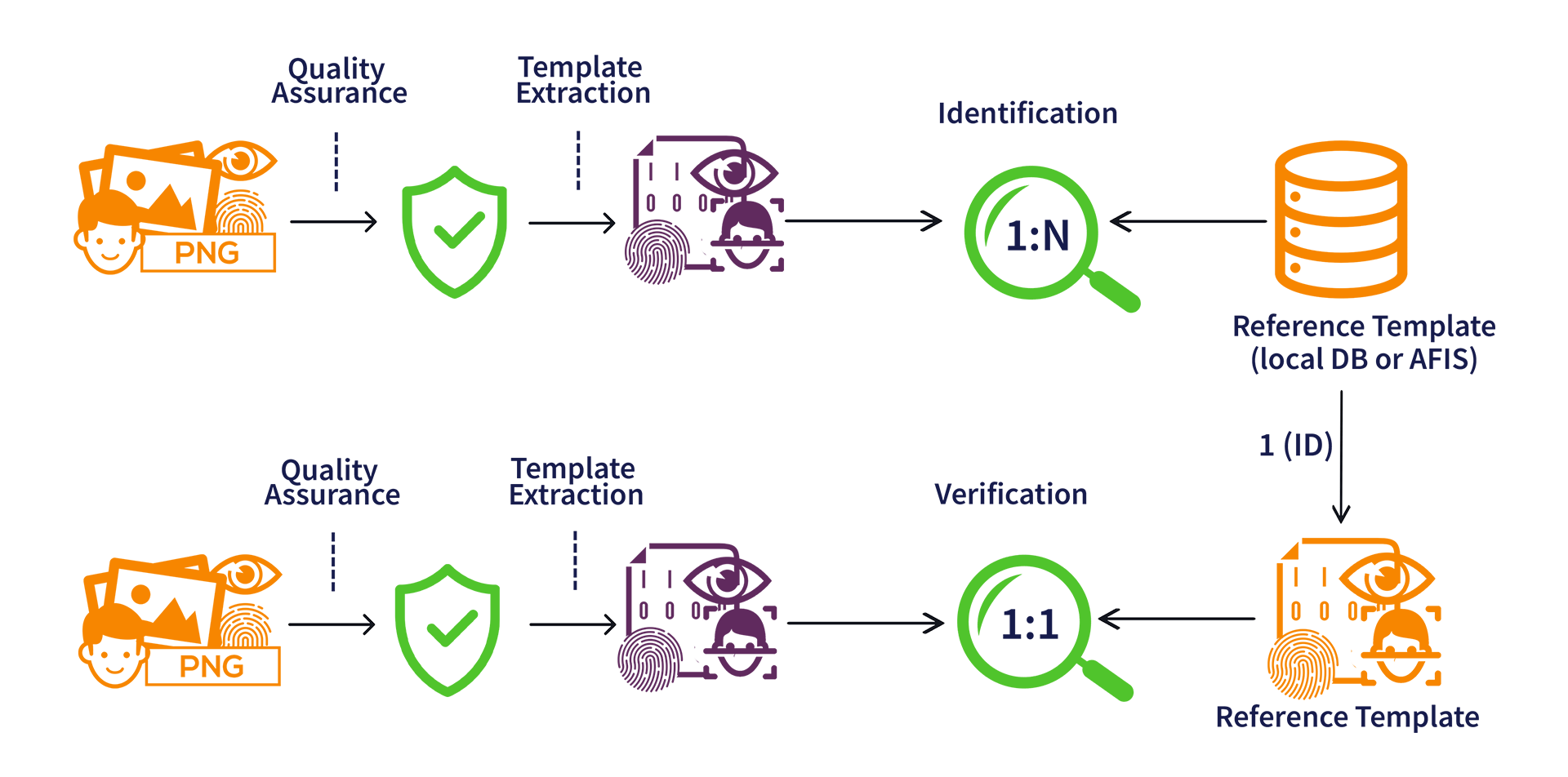

COMPAS e-KYC uses a proprietary mix of Artificial Intelligence and ID Expects combined with Fingerprint, Face, IRIS, and Voice recognition biometric authentication software to determine if an identity document is authentic and belongs to the user.

Benefits

How Your Business Benefits Using COMPAS eKYC Solution

- Enhance KYC onboarding with Biometrics – Fingerprints, facial, Voice or IRIS– Take your KYC process beyond the physical world to include both the visible and hidden online presence of your customers

- Improve Confidence Through Online Validation -Substantiate your existing KYC findings with data points found in the online realm

- Save Money by Introducing Automation to Your KYC Data Collection – Stay updated on risks with on-demand reporting and monitoring to help streamline your decision-making process

- Complement Your Existing KYC Infrastructure – Integrate our API-based query tool with your existing processes with little overhead and immediate time-to-market to help increase ROI

- Keeps Banks Compliant by locking out risky customers whilst providing quick access to legitimate users; ensuring KYC and AML compliance.

Ready to Experience the Difference with COMPAS KYC solution?

Stop worrying about technology problems. Focus on your business.

Let us provide the support you deserve.