A vast majority of banks will inevitably witness a shift from physical to digital channels, mostly web and mobile. This will result in huge consequences for how they do business. Effective digital sales capabilities and streamlined, end to end digital origination processes will start to play an integral part as banks plan their digitization strategy.

In the current financial scenario, it is imperative for banks and other financial institutions to retain their existing customers while acquiring new ones. Today, therefore, banks are trying to provide an end to end digital buying and contracting experience that is easy, personalized and friction less.

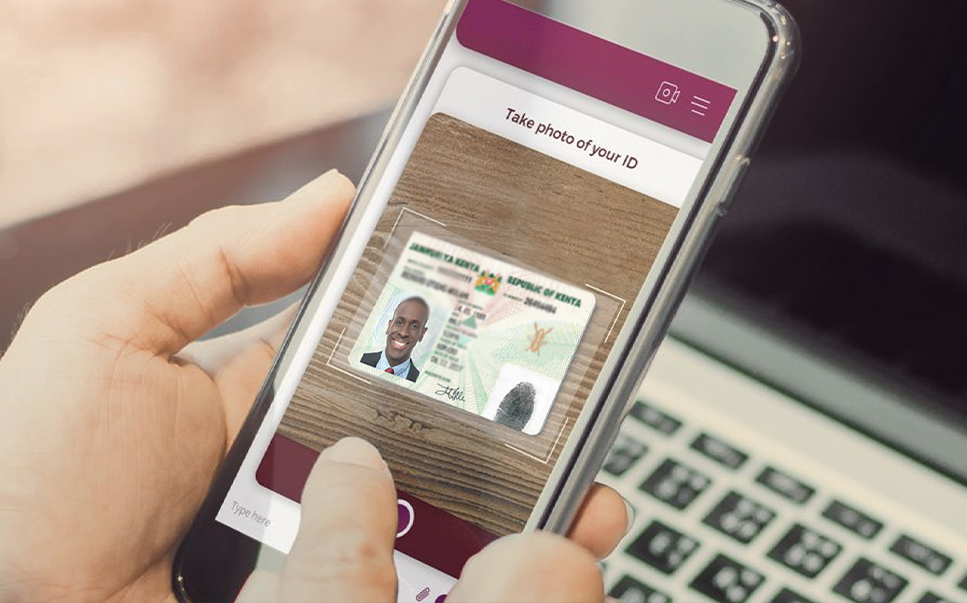

Digital onboarding is one such mechanism used in the banking sector to open up accounts and gain new customers. The introduction of digital onboarding for new customers transforms the process of opening an account to a seamless and convenient one.

Using digital IDs to enable electronic KYC (e-KYC) and completely digitize the onboarding process makes it easier for people to open an account and more affordable for financial service providers to reach out to underserved customers, especially in rural and remote areas where the establishment of a brick and mortar branch is not economically viable.

As trust is the cornerstone of financial services, digital identity is important for creating an online trust model that helps to verify transactions and user identities reliably. The convenience brought about by smooth and intuitive authentication, such as the use of biometrics and mobile devices, is also important, particularly for people who are often not used to digital services.

Digital financial services and branchless banking services can be offered across several platforms, such as mobile phones, retail point of sales, other commonly available access points and field agent banking. Users can also select which channel is best suited to their needs.

The comfort of having financial services at their doorstep is huge for people who often have to travel long hours and lose a day’s wages to reach a bank branch. Finally, by achieving a critical mass of customers and reducing the operating costs with digital processes, the financial services provider is able to deliver services at affordable costs.

Leveraging their long-standing customer relationships and an established track record of reliability and sustainability, many traditional banks are now developing financial technology and collaborating with technology providers to expand their digital offering. As the industry shifts towards the digitization of banking services, digital onboarding will soon become the standard, providing the banks with advantages such as:

- Customer centricity –Keeping the customer at the center of focus is the only sustainable way to develop a business and enhance with intuitive navigation. It means not only the gathering of data and bearing an inevitable administrative inconvenience, but also understanding the needs of the prospect. The digitized workflow allows the process to be built around users and their preferences

- Fast Onboarding –Bank onboarding is normally a cycle of high friction, go to the office, stand in endless queues, messengers and tedious paperwork. What has taken an average of three weeks in a traditional banking scenario so far can be completed in three minutes. The digital onboarding of clients incorporated in a bank can register an individual at that time with all the needed requirements and additional documentation that the bank itself may require for their needs

- Easy to use –The process itself and the details involved are easy to understand and implement. A big advantage is a change from paper to data that allows for improved rearrangement, autofill implementation to avoid asking the same questions, user-friendly and interactive information and digital signatures. Any person who has an electronic device with Internet access and an integrated camera can operate a digital onboarding procedure that prevents needless rerouting to physical channels by interacting with the web interface or the banking application.

- Robust and real-time security –Digital onboarding has several built-in measures to ensure that stringent security is maintained. Security measures are also taken in real-time; the biometric pattern of the face validates accurate online identity authentication and the life existence of the individual.

- Enhance productivity –One of the most important advantages of digital onboarding is productivity. With the help of system guided data validation, data errors, internal handling effort and time are all reduced.

In Conclusion, digital user experiences are inevitable. Adopting a digital onboarding approach is a necessity to keep up with all the rising digital options out there now, such as online-only banks.

By Carolyne Rabut

Content Marketing – CompuLynx